Does what it says it will, particularly, a simple way to set up a high yield saving account. What's even better, is that it tracks my cash and investments across various accounts. 4/5 stars because it does not initially let you deposit checks by photo until you've moved some secret amount of money into the account. There's also a digital debit card that I was not granted access to immediately, but did eventually get again after meeting some secret criteria. More transparency is needed.

I've been using Wealfront for a year now, and it's been great. What stands out to me is their customer service and transparency. They're constantly adding new features. Most of them are actually useful. The UX is great, very minimalist. A bit too minimalist for my liking. I wish they provided more details about performance. One feature I don't find useful is "Path", where they project your portfolio into the future. I wish I could disable it and just show a balance graph or something.

Intuitive and easy to use app. Its a one stop shop for all things finance where you can open a high yield savings account (called cash account), connect your bank accounts to the platform for fast deposits and even faster withdrawals of thousands of dollars thay litetally takes minutes to transfer. There's also a nifty net worth tracker built into the user interface. Instead of using multiple platforms or banks consider using wealthfront to simplify your finances.

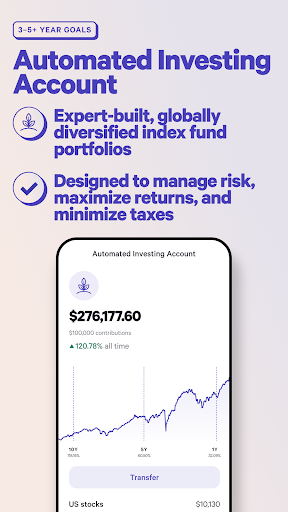

The UX is great, I find it very intuitive. I also really enjoy playing with the estimates: how would my retirement age change if I bought a house, saved more money, etc. The app is *almost* gamified, and I notice that it subtly presents the idea I'm doing better than I am: adjusting the time frame for investment payback can dramatically change the the reported return rate on investments. All that being said, it's very easy, I think it gives a good overview, and is a good additional investment.

Really good app. The only thing I wish is that it would allow me to change my address without having to login through the desktop website. Customer service were really helpful though and guided me through the process. Update: The feature to segregate your savings is such a game changer. I can allocate my money within the savings account and create categories! Just amazing!!

Cannot speak on the investment portion as I have just started but I definitely DO NOT recommend the cash high yield account. I had put money as an emergency in tere and when I went to actually use it with the debit card they provide you. They locked my account! I had to submit ID to verify myself which failed. They said it could take up to 2 business days to unlock my account! I cannot recommend their cash account because you can lose access to your money and they cannot unlock 🤦

Used this for a year. App worked great on Monday and on Tuesday without notice, they must have done an update, and now it doesn't work at all. It's incompatible with my phone. Mobile banking would lock me into updating the app, which of course, doesn't work! Banking on a desktop computer is useless to me. Immediately moving to another online bank for better rates and to be able to access my accounts on the go. Definitely would not recommend any longer.

Brian Cohen (Brian H Cohen)

This used to be a financial aggregation app, where you could see all of your accounts and investments in one place. Now it appears to be entirely an ad for their automated services, and the only thing that made it useful has been removed. Zero stars, lowest possible rating, will uninstall. Update: got a message saying the developer responded, but there is no response. They appear to be suppressing this review. You can add dishonesty to the list of complaints.

Great service, exceptionally low fees, basic dashboard to keep all accounts together. Terrible UI for modern features. It's got categories, great, but not a way to lock them, or to sort them like a playlist, it just goes by amounts. And what's worse is users cannot directly deposit money into categories which becomes a nightmare when using it as a debit card.

It's setup is really easy and helpful. Something that caught me off guard was that the transfers take a day or two to be finalized and accounts updated, but at first I want sure if it had bugged out or calculated incorrectly. Just make sure that if you've never done this before, you're patient and wait a day or two after every move you make to let the numbers fully update. Otherwise, it's been a great way to get into investing.

Very intuitive GUI! Info is easily accessible to help you understand where your funds are going and how they impact your overall plan. Even if you don't invest with Wealthfront, the ability to track your finances in one simple location makes the app worth it. Unfortunately, linked account update times vary depending on service. My T. Row Price connection is especially finicky. The app still provides a great overview, but be sure to cross-reference your accounts for more accuracy.

Great concept, and no mishandling of my funds yet. However, the app has two bugs I have noticed so far. 1) Negative balances in loans are shown as positive on the balance screen and 2) Sometimes when linking external accounts, the process bounces back to the login screen without any notification. Then I have to return to the home screen to see a notification that the account needs extra verification. This bug makes adding accounts somewhat tedious.

Update after funding my account from a laptop: once set up the app is quite nice. Remaining annoyances: no obvious way of force refreshing external balances, no progress tracking and seemingly no learning for categorizing past transactions. ------- Can not complete setup as I can not link either of the two bank accounts I tried: when there are multiple modalities for two factor authentication (e.g., voice and text) one can not confirm the selection, the submit button stays grayed out.

It was easy to set up the account and start the investing, but I removed a star because I think the interface could really use some work. I started a general investment fund but they treated it like a retirement account. I wanted to set a different withdrawal date and finally figured it out, but its not very intuitive. Also, I would love to see more stats, which stocks and bonds I'm invested in, how it does day to day, how much I've gained since inception, etc.

App is convenient for depositing funds and seeing investment mixes and has a nice UI, but the account links are constantly down! My cc bill hasn't updated in a year, but other accounts I have through the same bank are up to date. I haven't been able to add my new institution for months. This means none of my projections are accurate, so it renders much of the app useless to me. I really liked the projection and goals features a few years ago. Might have to go web only.

(edit) *updated to 5 because its been working great for years! Still has those old quirks below, but they're forgiven* Great app and interface! It definitely has a couple kinks like how it accidentally created and funded two separate accounts when I signed up, or how the retirement path chart drops from 1million to 0 without explanation in 40 years. But when its working correctly, its awesome! I'll continue using it.

So far it's been very straightforward in managing my account, setting up transfers, etc. The app will show you estimated times on when transactions will be available or ready to view and there's lots of other features I have yet to utilize. This app is simply well-made and does what you need for banking, nothing more and nothing less! User interface inside the app is not too complicated and the organization is very delightful for me as a new user. Definitely recommend!

I really like this platform for it's ease of use, clean and attractive UI, very easy to transfer money in and out of cash accounts as well as investment accounts. New same day or one day. Cash transfers are really nice as well. I just wish the process for liquidating a stock position was faster. All in all, I still really like it and continue to use it as a really great option for a high yield cash account for cash savings. I use other platforms for primary investing but love this for savings!

The user interface of the app is very intuitive, and they make setting up different accounts and connecting them to other bank accounts very simple and streamlined. I love how I can see how much I'll save in a few decades with their algorithm. Very well-designed and easy to use. However, the app does not update my mortgage and a certain bank account that I closed a while ago, so it'd be great to see that improvement. Overall, highly recommend if you're looking into robo-investing!

Great to see my accounts in one place. love the net worth calculator and predictions for future retirement/spending capabilities. only issue with the app is that it's not very easy/intuitive to renew links with external accounts. I wish I didn't have to renew as frequently, but I understand the security aspect of it. the app can do better in the renewing process. Right now it's unclear that you have to click renew and prompt the text and then exit and click renew again to enter the texted code.