Appreciate this app very much! Huge benefits to budgeting & easy to use. Highly recommend to anyone trying to track their spending & budget wisely. However, it often freezes & glitches. Sometimes does not load all the transactions properly. Will freeze after using for several minutes, won't refresh, & will have to close & re-open. Fixing these bugs for Android would be great!

A recent update seems to have greatly diminished the experience. Changing the name of a budget item now insists on changing it for all past budgets for "Insights" that I can't even access. This is a big problem for sinking funds. I can't change "Insurance 1/6" to "Insurance 2/6" anymore without fudging my past records, and it's not realistic to make a new item for all of these every time. Every app seems to eventually have an update that causes you to turn off auto updates. This is it.

Product is glitchy and many times the hyperlinks to wherever you're going do not work. Currently trying to cancel the subscription and...WOW. I followed every direction I have uninstalled and reinstalled and every time I hit the edit button on the subscription (Yes I'm going into accounts) The link to "edit your subscription" does not work.

This method/ app works! I was enjoying the app until I received an update a couple days ago. Every time you try to edit a total or view purchases on a line item it now selects the line item to reorder it in your list a hundred times before letting you do what you want. It's a big pain. I have opted to still give 5 stars not because it deserves it in its current state, but because you can/ will save money using it and I have faith the developers will fix the issue.

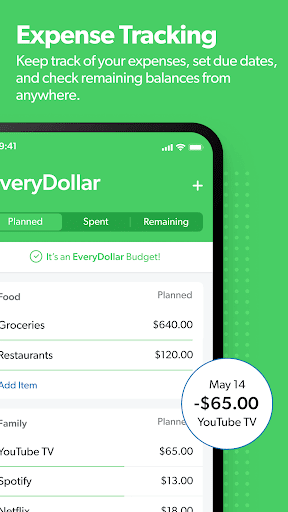

Forcing me to sort expenses is awesome! I love it! But... the export to csv is insufficient in that "account" and "notes" don't get included in the export. I find that unacceptable. As such, I continue to use my other tracking app (Empower) and merge and sort fields in my Excel file. I've previously requested twice that EveryDollar update their csv export (should be easy).

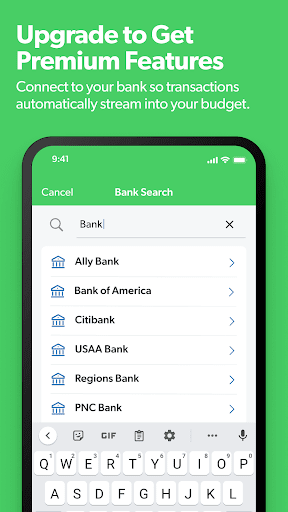

About a year ago I downloaded the app. I went premium because I wanted to be able to track my checking account in the app. Things were peachy keen, and I -loved- the app and all the features that came with it. About a month in, the app and my bank began having connectivity issues. I would constantly have to reconnect, sometimes in the middle of using the app. I just downloaded it again and now it won't connect at all. Overall, the app itself is fantastic, but these connection issues are a wash.

Doesn't sync with bank your account. As some of the reviewers have pointed out. The first time you work with it it syncs just fine but it will not automatically sync even after the 24-hour period that the app says it will. You end up having me put it in all manually. That's why I gave it to two stars. Although I do like Dave Ramsey and his stuff. This obviously isn't something of his quality. Edit- still doesn't sync after 24 to 48 hours of being posted to my bank account.

App is ok...a couple things that would make it better would be for the little line under a budget item (that grows when you spend) to be a diff color such as red. It is small and not very visible in the sea of green on the screen. Would also be great if the android version would open to the budget tab instead of the lessons tab.. currently its just another thing to click and do in order to be able to track which seems dumb considering the whole point of the app is for tracking.

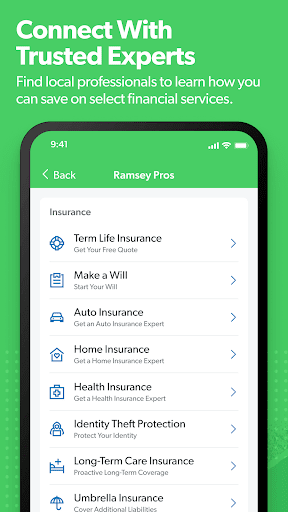

I'm a full believer of the Baby Steps. It helped me and my spouse get out of debt. We even decided to buy the primium version (and this review is just for that). This app was great 2 years ago, but has just gotten worse. Many of the of the importing features have gone down hill and the fix process takes way to long. Sometimes you will just not see anything done. For example, some Citi cards will work for "one" user. But if you share a different Citi card with your spouse, then good luck.

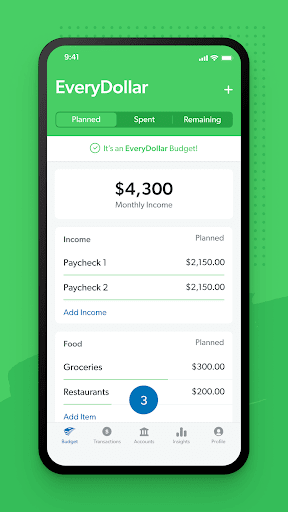

I just successfully completed my first month on budgeting for January 2025, and I absolutely LOVE this app! Someone in the reviews stated that it was more beneficial for them to not link their accts and instead manually input their transactions, and that's also what I did. Works perfectly! It's just so easy to use! It also copies your previous months budget over to the next month, and you can adjust if needed. All this with the free version! So simple, and at least worth a try!

if you're wondering where your money is leaking this app will help you find it. What a blessing! Sustains. 1. user friendly 2. allows you to forecast your budget months ahead. 3. the manual input of items help you stay intentional and focused Improves. 1. a version that allows all members of the household to be logged into the same budget would be perfect. 2. an "undo" button when you accidentally delete a budget item would be helpful.

Vinson Armstead (WhereHasMySanityGone)

Best, easy to use, and most comprehensive financial management app you can find! Everydollar (ED) gives you all the tools to not only develope a reality based financial budget, but also has features to integrate with one or multiple accounts to help automatically track those in your monthly budget. The interface is ease to use and customize, allowing you to get started quickly and adjust/customize over the first few weeks. Highly recommend for those looking to easily develope and manage your $$

This use to be an excellent app, it's garbage now! They changed the way that you were able to edit your entries, you can no longer label your entries on a monthly basis, so you have to say "gym" on month March gym 2 on April's budget. You have to keep renaming the same budget item differently every month when you were able to just keep renaming your budget item line the same because NOTHING HAS CHANGED IN MY NAME FOR THE ITEM SUCH AS GYM!!!

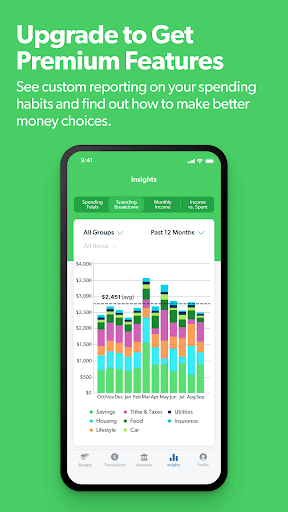

I like the ability to share account login through devices so we can work together with my wife and it's overall clean and to the point without any bloatware. I would like to have all the features available on the mobile app (name changes, money transfers through categories), the graphs are not that useful and there is no dark mode.

Really want to love this app. Budgets aren't allocated to every month, but allocate themselves sporadically. Any favorited items don't always show up in certain months so you have to manually add them. That part sucks for saving funds because you usually see how much accumulates after every month but this app is kinda broken. So far I haven't found another app to replace this very simple easy to navigate one but I will keep looking.

Second time I tried a budget app. Like the one I had previously this one stopped working not getting data from the accounts. I'll go back to my Excel spreadsheet do this manually as I've ever done, way better than trust in an app that will fail and mess up with the work you put on organizing the budget.

Every Dollar is fantastic. I use the free version, and I enter each transaction manually. I have never connected my bank to the app, I think thats why people have problems with it. So try entering your transactions manually, one at a time. I have been using this app for 5 years and it's awesome. What I like most is that it gives me something visual to follow. This app actually works, it does the math for you. It's worth the time to use.

CON: the app stops responding after 10 minutes of categorizing expenses. This is the only activity it freezes up. Then i need to close & reopen app. All other features work great 100% of the time. PROS: When it is working, I love the simplicity! It is very easy to sort my expenses (took some time to figure out), creates nice visuals of my spending, am able to connect all my accounts and see all balances in 1 place to determine next goal. Overall, I think the pros outweigh the con hence 4 stars.

The app is good and super helpful for budgeting.. The only downside is that it does not show how each expense or income entered impacts the budget you've set It'd be good to add the ability to see the overall amount left in the budget when you enter an expense or even income. Just like a bank account, when you withdraw or deposit money, you can see rhe total of what is left in the account.

Edit: They have taken the feedback and I have noticed an increase in their quality of software. Still a great app for budgeting! Original: This budgeting app offers a free basic plan and a premium plan with additional features. The free version lets you manage your monthly budget. The premium version adds bank account syncing for automatic transactions. 3 stars for how buggy the app is. The developers really need to have a a better testing system in place before releasing stuff as "production".